Cable sold off modestly on the day after BoE's first 'Super Thursday' release of its rate decision, Quarterly Inflation Report and Minutes were taken dovishly by the markets. British construction output returned to moderate growth in June appeared to have no impact on the pound. Analysts think this is an appropriate response and expect further reduction in GBP long positioning in the market.

Despite more dovish BoE, domestic economic trends remain sound in the UK. Wages are rising fast, signaling that the unemployment rate is approaching NAIRU. The BoE however seems in no rush to hike before the FOMC, even though wages are rising quickly. Governor Carney also stated GBP strength was having an impact on policy, but noted it hadn't removed the need for gradual rate increases.

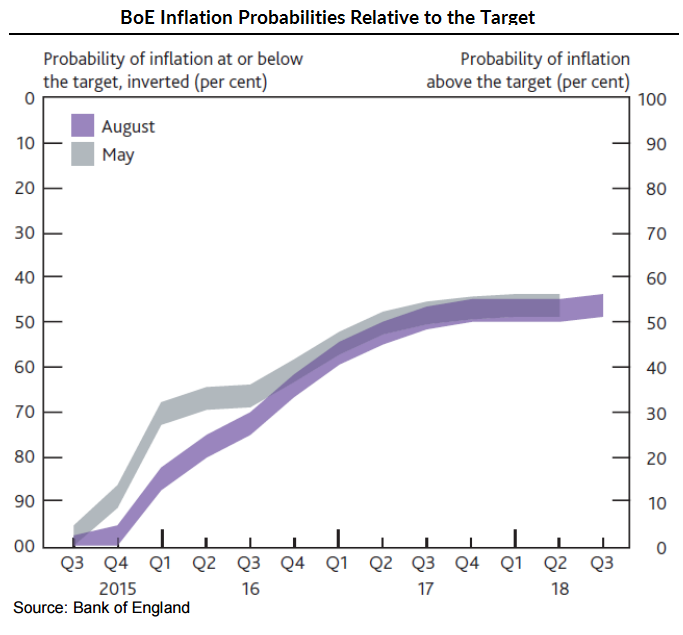

While the BoE's inflation forecasts were mostly unchanged, the probability skew shifted in favor of downside surprises. Heightened risk of disinflationary surprises was clear in the number of times GBP strength was mentioned in the minutes as a headwind. In the minutes from the August meeting, the FX rate was mentioned 17 times versus only 8 times in July.

"Sterling looks well positioned to bounce against the majors, but investors (would be) better keeping things light before inflation data and retail sales next week," wrote Citi bank currency strategist Josh O'Byrne in a research note.

The MPC seems comfortable with market pricing of a hike in Q2 given its unchanged inflation forecast. There was only one dissent in favor of a hike, despite consensus of two dissents and risk of three. Meanwhile the Norges Bank is moving in the opposite direction, signaling more easing to come as oil prices stay soft. Norway needs an even weaker currency to improve competitiveness in the non-oil sector.

"In general, the fundamentals of the UK are strong and we expect GBP to be a relative outperformer in G10. We like GBP against the commodity currencies and remain long GBP/NOK in our Strategic FX Portfolio", said Morgan Stanley in a trading note to its clients.

For the week, the pound was up around 0.7 percent against the broadly weaker dollar, on track for its best performance in almost two months, and trading flat at around $1.5609 on Friday. Against the single currency, the pound eked out a 0.1 percent gain on the day, trading at 71.395 pence per euro. But for the week, it is down around 0.8 percent. GBP/NOK is trading at 12.7797 on the day.

Caution Warranted on GBP Longs

Friday, August 14, 2015 11:37 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate