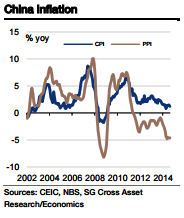

The biggest contributor for China's CPI should have been faster food inflation. The high-frequency agriculture prices pointed to a mom increase of 0.5% in food CPI in June, compared with -0.9% in May.

If that proves to be the case, the yoy rate of food CPI should have ticked up by a full percentage point to 2.7%. In addition, housing inflation likely edged up further amid the strong recovery of housing prices in major cities. CPI is on a slow-moving upward trend, partially thanks to base effects.

"China CPI is expected to rebound to 1.4% yoy from 1.2% yoy in May", forecasts Societe Generale.

If this is indeed the case, it will limit the scope of further easing for the PBoC. PPI likely remained unchanged at -4.6% yoy in June, implying a mom rate of -0.3% (vs -0.1% in May). In both the Markit and official PMI reports, the input price index deteriorated in June, indicating that there are still immense deflationary pressures on the manufacturing sector.

China Inflation to bottom out

Wednesday, July 8, 2015 5:26 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX