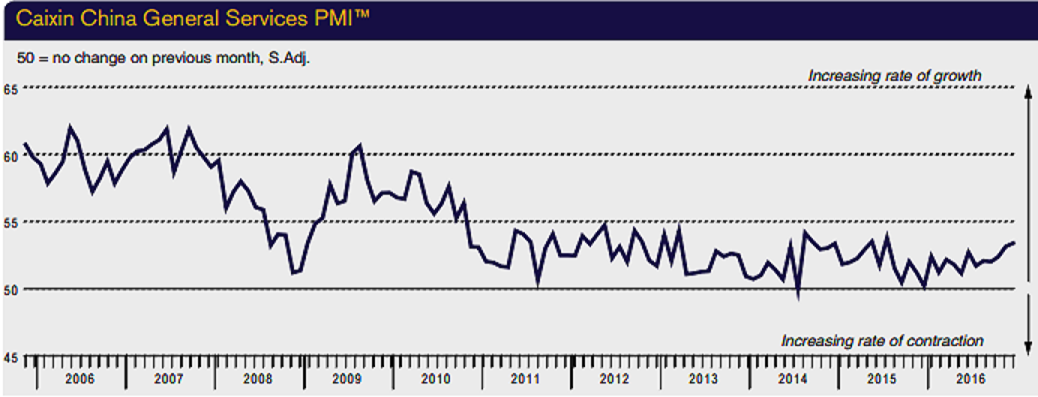

Chinese service providers saw growth momentum pick up further in December, with activity and new business both increasing at the fastest rates in nearly a year-and-a-half. As a result, companies were more optimistic towards the 12-month business outlook, with the overall degree of positive sentiment rising to a four-month high.

The headline seasonally adjusted Business Activity Index registered at 53.4 in December, up from 53.1 in the previous month and signaling a solid expansion in services activity. Notably, the latest reading indicated the fastest rate of growth since July 2015.

On the prices front, services companies registered a solid increase in average input costs during December. Furthermore, it was the quickest increase in cost burdens recorded for nearly two years. A number of companies mentioned that higher prices for raw materials were the principal driver of cost inflation.

However, companies were cautious towards staff hiring, with the rate of job creation easing from November’s recent peak. Input prices meanwhile rose at the quickest rate in 22 months, but strong competition for new work led to only a slight rise in selling prices.

Higher business activity led firms to add to their payrolls again at the end of the year. However, the rate of job creation slowed from November’s 18-month peak to its weakest since September. At the same time, latest survey data signalled little pressure on operating capacity despite rising new order volumes, with backlogs of work broadly unchanged compared to November.

Services companies were generally upbeat towards their growth prospects in 2017. Moreover, the degree of optimism reached a four-month high, with a number of companies linking confidence to forecasts of improving market conditions and company expansions.

Meanwhile, USD/CNY traded at 6.90, down -0.57 percent, while at 6:00GMT, the FxWirePro's Hourly Yuan Strength Index remained neutral at -65.76 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm