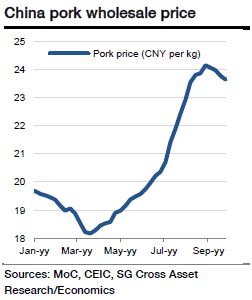

China's CPI inflation strengthened to 2% yoy in August from 1.6% yoy in the previous month. This was purely driven by stronger food inflation that increased by 1pp to 3.7% yoy, mainly on the back of higher pork prices.

Non-food inflation remained unchanged at 1.1% yoy. That said, pork prices have declined slightly since the beginning of September. Agricultural product prices dropped over the same period. Therefore, food price inflation is expected to have softened from 3.8% yoy in August, foresees Societe Generale.

At the same time, administrated fuel prices were lowered further in September. That said, the weakness is likely to have been offset by a positive base effect in the non-food CPI inflation. Stronger services inflation, thanks to the buoyant tourism sector, is also likely to have raised the non-food CPI. Overall, the CPI inflation is likely to have ticked down to 1.9% yoy in October from 2% yoy in September, added SocGen.

PPI dropped sharply by 5.9% yoy in August after -5.3% yoy in July, mostly owning to a slump in oil prices. In September, the oil price increased slightly while the input price gauge in the manufacturing PMI report increased 0.9 points to 45.8. Hence, analysts expect a smaller sequential decline in the PPI. However, due to a negative base effect, the yoy rate may have recorded a faster fall of 6.1% yoy in September, argues SocGen.