The implications of China's dimmer growth outlook is likely to be fully priced into risky assets globally, particularly in EM.

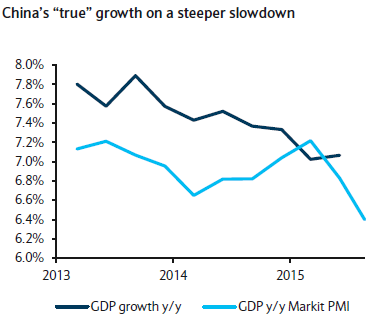

China growth forecasts for 2015 and 2016 has been cut to 6.6% and 6.0%, from 6.8% and 6.6%, while keeping a negative bias toward risks and the "true" pace of economic activity relative to official statistics, estimates Barclays.

Despite the recent focus on the CNY, this negative growth backdrop likely has a much larger implication for the global economy and asset markets. While bearish, the growth outlook is not catastrophic, as healthy consumer spending and supportive infrastructure investment should partially offset the secular slowdown in private investment, particularly residential, says Barclays. However, the net effect is not only a slower economy but also increased risks of a hard landing.

Despite the elevated risks, USDCNH 1y volatility has risen only moderately since August 11, likely influenced by heavy official intervention.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed