Today, at 2:00 GMT, GDP numbers to be released from China. Today's release would be a challenge for Chinese authorities as well as Peoples bank of China (PBOC) which has aggressive stance since late last year in its bid to boost ailing economy.

Weaker than expected release today, would send shock waves through financial markets especially commodity prices across the world.

Chinese authorities have targeted 7% GDP growth this year, however other economic releases such as PMI, industrial production shows that growth is likely to be lower than that.

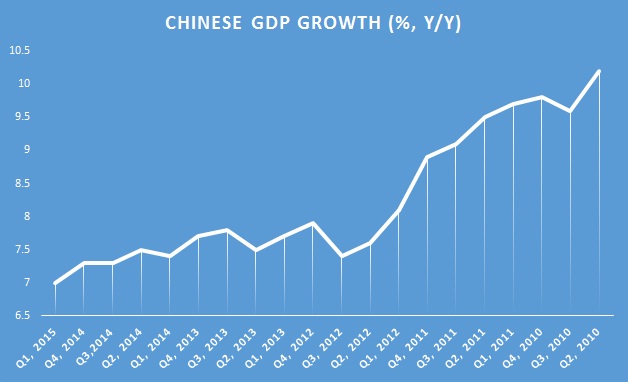

Past Trends -

- Since 2008/09 crisis, Chinese GDP has been slowing down steadily, however slowdown has gathered pace post 2011. Since 2014 slowdown again has gathered some pace after stabilizing in 2013. The detailed chart is shown above.

- In first quarter 0f 2015, GDP grew by 7%, compared to 7.3% growth registered in fourth quarter last year.

Expectation today -

- Median expectation today is around 6.9% growth for the second quarter.

Impact -

- A slowdown worse than what market is expecting would increase risk aversion across commodity sphere and even might dent sentiment in stocks.

- Chinese stock market, which is trying to reverse course after massive fall since June, might face renewed selling pressure if GDP growth becomes weaker than expected.

- Stronger number would boost commodity segment as well as commodity currencies, especially Australian dollar. Aussie is currently trading at 0.746 against dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?