Worries about the Chinese economy have intensified as high frequency data including PMIs disappointed in recent months. The CNY fixing devaluation in August did not help sentiment. Even as the People's Bank of China (PBoC) kept the CNY fixing relatively stable over the past two weeks, pressure on the CNY to weaken remains.

Upward pressure on money market rates have thus far been contained even as there was suspected intervention by the PBoC to reduce volatility in the CNY. Domestic liquidity has been kept ample with injections from open market operations increasing significantly in August, Chinese growth concerns are likely to linger in the coming (with potentially further outflows to come) but a liquidity squeeze in short-term CNY rates remains an unlikely scenario.

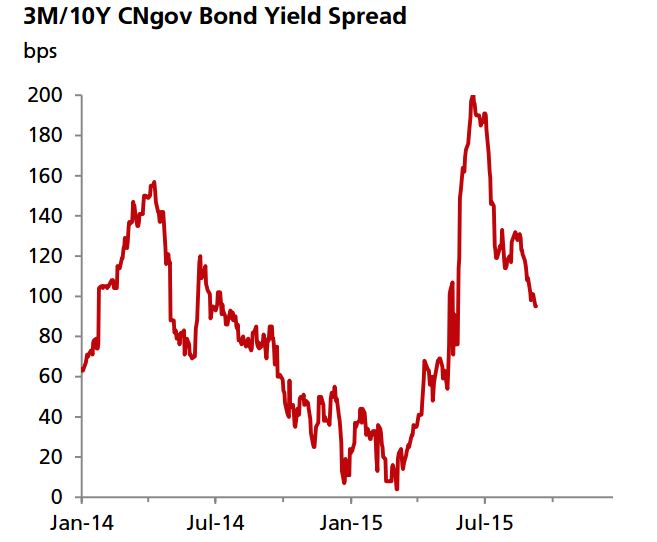

According to DBS Bank, there remains ample room to inject liquidity in the financial system with further reserve requirement ratio cuts likely in the coming months. Against this backdrop of economic growth concerns, DBS Bank says that it suspects that the 7D repo rate is likely to hover between 2-3%. Any whiff of stabilization is likely to prompt steepening in the CNY swap and CNgov curve.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX