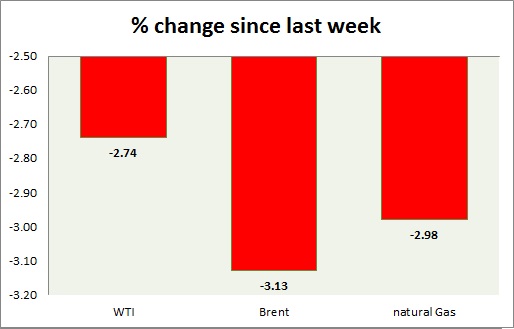

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price is moving down despite Middle East tensions as inventories continue to build amid sharply higher production. Broad trend is still bullish. Up today as risk aversion faded. Today’s range - $66- $67.3

- WTI is currently trading at $67.4/barrel. Immediate support lies at $63 area and resistance at $69 area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. The recent disappearance of a Washington Post journalist at Saudi Consulate has triggered an international backlash and the market is pushing prices higher on fear of sanctions on Saudi Arabia. Today’s range - $75.3-76.8

- Brent is trading at $9.3 per barrel premium to WTI.

- Brent is trading at $77.3/barrel. Immediate support lies at $73 area and resistance at $81 region.

Natural Gas –

- The natural gas price has cleared sellers around $3.10 area. The lower level of inventory is providing support as winter approaches. Next target $3.47 per MMBtu. Today’s range $3.14-$3.24

- Natural Gas is currently trading at $3.12/MMBtu. Immediate support lies at $3.10 area & resistance at $3.47

|

WTI |

-2.74% |

|

Brent |

-3.13% |

|

Natural Gas |

-2.98% |

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022