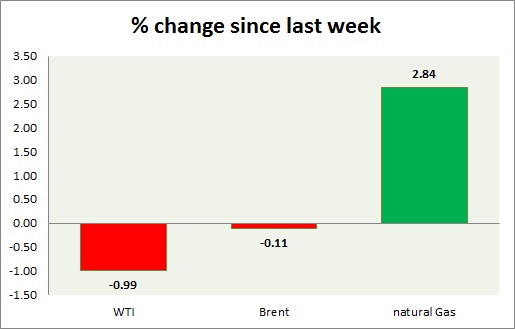

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI is continuing its consolidation amid a positive OPEC deal and higher production elsewhere. Russian and Saudi Arabian oil ministers met to show unity in the deal. It is positive for the day so far. Today’s range $52.6-52.9

- With an OPEC and non-OPEC deal done, the oil price is likely to reach $59 and $68 per barrel. However, WTI might decline to $46 per barrel in the short term.

- WTI is currently trading at $52.8/barrel. Immediate support lies at $49 area and resistance at $57 area.

Oil (Brent) –

- Brent is marginally better performer than WTI this week. Today’s range - $55.8-55.5

- Brent is trading at $2.9 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $55.7/barrel. Immediate support lies at $52 area and resistance at $58 region.

Natural Gas –

- Natural gas target extended to $2.3 per MMBtu. It has recovered from earlier loss. Sell here at 42.9 per MMBtu. Today’s range $2.83-2.91

- Natural Gas is currently trading at $2.9/mmbtu. Immediate support lies at $2.5 area & resistance at $2.9 and $3.1

|

WTI |

-0.99% |

|

Brent |

-0.11% |

|

Natural Gas |

+2.84% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022