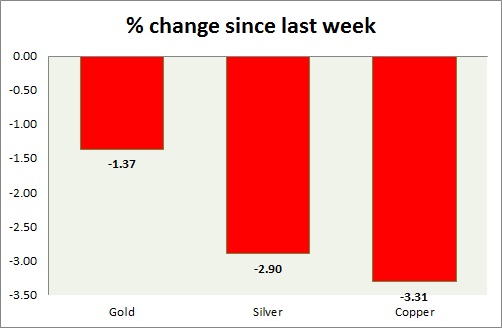

Metal pack is in massive red today. Performance this week at a glance in chart & table -

Gold -

- Stronger dollar spoiled the rally for gold bulls. Target of $1252 still remain active, however bears have taken control as of now. Bulls need to show strength at support to reign over bears.

- Gold is currently trading at $1208/troy ounce. Immediate support lies at $1208, $1178 and resistance at $1236-1240 area.

Silver -

- Silver failed to break key resistance area of $17.5-$17.7 as strong dollar made bears stronger for now. However sellers should remain cautious as bulls might pose strong showing at supports. $16.5 might provide interim support.

- Mint ratio is up +2.8% today, currently at 71. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.97/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Bears have once again taken control, due strong comeback of dollar. Further downside remains open.

- Short term sell is recommended since $2.95 held strong.

- Copper is currently trading at $2.83/pound, immediate support lies at $2.76 & resistance at $2.95, $3.07. $2.89 would provide interim resistance.

|

Gold |

-1.37% |

|

Silver |

-2.90% |

|

Copper |

-3.31% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings