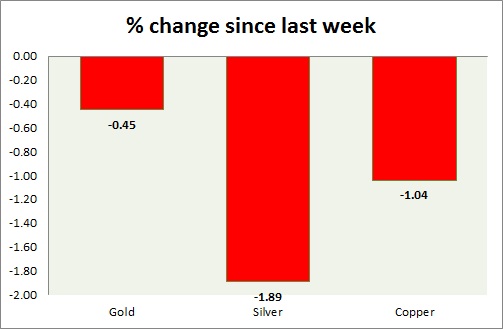

Metals continue to gain after the comments from FED governor Janet Yellen and remain the top performing asset class this week. Performance this week at a glance in chart & table -

- Gold - Gold bulls fought back well from the low of channel support after the comments from FED chair Yellen was taken as dovish but scaled back the gains made after stronger durable goods order and wage print. Gold may remain in whipsaw mode until further queue comes from next week's mega events. Gold is currently trading at $1207/ troy ounce. Immediate support lies at 1190 & resistance at 1224.

- Silver - Silver still continuing the wait and watch mode but may be in control of the bears since it failed to break above 18.6. Support lies at 15.5 & resistance at 17.6.

- Copper - Copper is the top performer for the day rising 1.5% so far. Copper continued its short term comeback after prices reached after prices touched the levels of $2.4/pound. The copper might very well reach $2.82/pound if it successfully breaks above the support cum resistance level of 2.72. The demand from the Chinese market is helping the red metal gain ground. Medium term outlook still looks bleak. The copper is trading at $ 2.68/pound. Immediate support lies at 2.62 & resistance at 2.72.

|

Gold |

0.58% |

|

Silver |

2.09% |

|

Copper |

3.12% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate