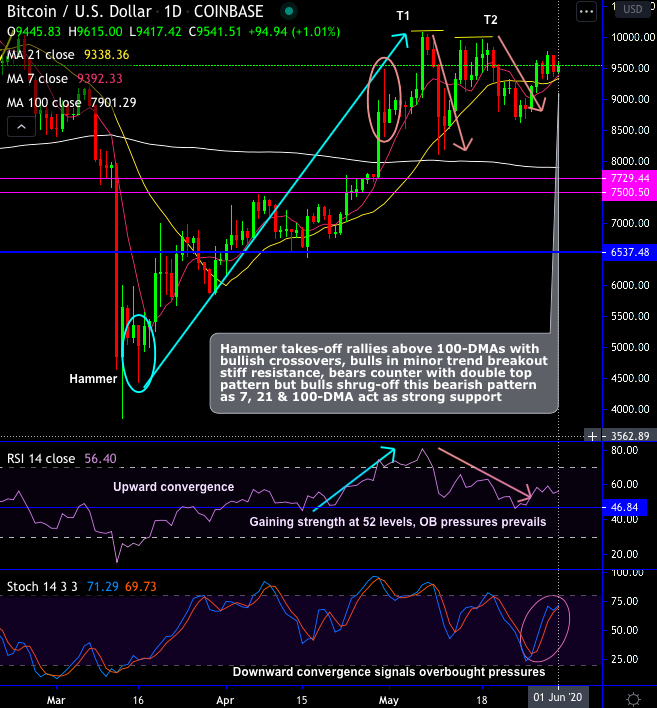

Bitcoin’s (BTCUSD at Coinbase) current price remained above 7, 21 & 100-DMAs, as it has decisively closed May’20 series well above crucial resistance levels and extended 3-months lows, the current price reclaims $9,500 levels.

But bears counter with the double top pattern as the leading oscillators signalled overbought pressures but 100-DMA acts as the strong support.

Prior to which, hammer takes-off rallies above 100-DMAs with bullish crossovers, bulls in the minor trend breakout stiff resistance amid this upward journey.

Since mid-March, BTC has spiked from $3,858 to the current $10,079 which is 160% rallies.

Amid such volatility, as we could foresee strong support at $7,900 levels (i.e. 100-DMAs), long hedges have already been advocated using CME BTC Futures when the underlying BTC was trading at $4,927 levels, and we wish to uphold the same positions with June months deliveries. It is unwise to keep speculating on the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the above advocated long hedges for now (spot reference: 9,526 levels).

With these long hedges, one can leverage and would indeed cut down market exposure, mitigate risks, and equips with the ability to either add longs or short their spot market exposures in smaller tranches later on.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty