Dollar index trading at 93.11 (+0.05%)

Strength meter (today so far) – Aussie +0.15%, Kiwi +0.27%, Loonie +0.90%

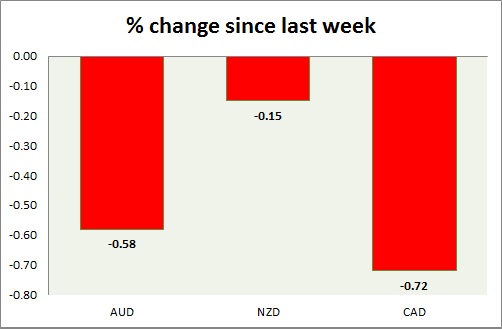

Strength meter (since last week) – Aussie -0.58%, Kiwi -0.15%, Loonie -0.72%

AUD/USD –

Trading at 0.757

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.75, Short term – 0.765 (broken)

Resistance –

- Long term – 0.825, Medium term – 0.8, Short term – 0.78

Economic release today –

- NIL

Commentary –

- Aussie is down this week as the dollar recovers and commodity prices remain weak.

NZD/USD –

Trading at 0.685

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.69 (testing)

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- NIL

Commentary –

- Kiwi is consolidating around 0.69 area and is likely to decline towards 0.64 area. It gave up earlier gains as confidence data declines sharply.

USD/CAD –

Trading at 1.278

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.28 (testing)

Economic release today –

- Employment rose by 79,500 in November and unemployment rate declines by 0.4 percent to 5.9 percent.

Commentary –

- Loonie is the worst performer this week on lower exports of crude oil amid lower price of West Canada Select. However, it has recovered sharply after blockbuster unemployment report.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX