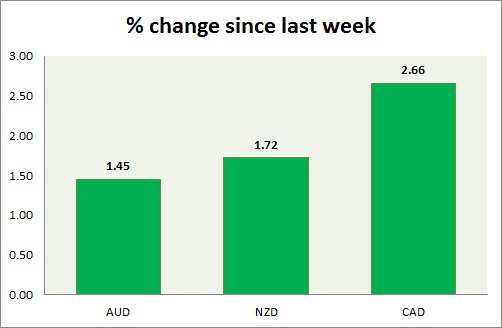

Commodity pairs (AUD, NZD, & CAD) found strength back from overall US dollar selling. A chart and table is attached for explanation.

- Aussie failed to gain much over better employment data as inflation expectation showed further weakness. Employment in February rose by 15,600 pushing the unemployment rate down to 6.3%. Inflation expectation fell further to 3.2% compared to previous 4%. Aussie is currently trading at 0.771, up 1.45% for the day. Immediate Support lies at 0.757 & Resistance 0.775, 0.785.

- Kiwi turned out as the best performer this week so far after RBNZ kept the interest rate on hold. Pair is currently trading at support 0.741, trying to break above previous support turned resistance. Immediate Support lies at 0.72 & Resistance 0.744, 0.752.

- Canadian dollar has not gained much in today's trading compared to its peers. House price index fell by 0.1% mom. Currently trading at 1.267, up by 0.50% for the day. Immediate Support lies at 1.258, 1.24 & Resistance 1.284.

|

AUD |

0.06% |

|

NZD |

0.95% |

|

CAD |

-0.39% |