Dollar index trading at 94.56 (+0.29%)

Strength meter (today so far) – Aussie -0.36%, Kiwi -0.35%, Loonie -0.19%

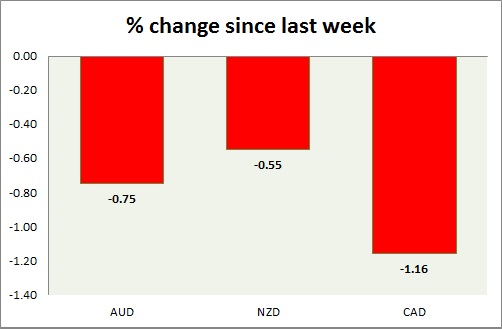

Strength meter (since last week) – Aussie -0.75%, Kiwi -0.55%, Loonie -1.16%

AUD/USD –

Trading at 0.723

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.67, Medium term – 0.7, Short term – 0.72 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.75

Economic release today –

- NIL

Commentary –

- The Australian dollar is down this week against a weaker USD. Bulls are likely to continue struggling.

NZD/USD -

Trading at 0.664

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- August building permits report will be released at 22:45 GMT.

Commentary –

- The New Zealand dollar is declining as RBNZ vows to keep the rate at this level through 2019 and 2020. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.306

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.29

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- BoC governor Poloz is set for a speech at 21:45 GMT.

Commentary –

- Loonie is the worst performer of the week as President Trump toughens his tone towards trade negotiations with Canada. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022