Dollar index trading at 96.89 (-0.21%)

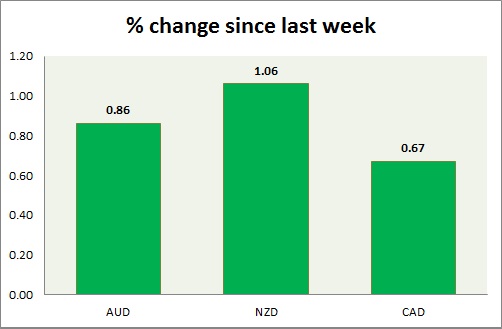

Strength meter (today so far) – Aussie +0.86%, Kiwi +1.06%, Loonie +0.67%

Strength meter (since last week) – Aussie +1.11%, Kiwi +1.48%, Loonie -0.41%

AUD/USD –

Trading at 0.731

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/buy

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732 (testing)

Economic release today –

- Building permits down 1.5 percent in October, down 13.4 percent from a year ago.

Commentary –

- The Australian dollar is likely to keep struggling amid a stronger economy and a stronger USD. The medium term trend is shifting to the buy side.

NZD/USD -

Trading at 0.679

Trendmedium-term

- ng term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.69

Economic release today –

- NIL

Commentary –

- The New Zealand dollar is the best performer of the week as a stronger economy weighs over stronger USD. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.328

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.33 (testing)

Economic release today –

- Markit manufacturing PMI rose to 54.9 in November.

Commentary –

- Loonie is the worst performer of the week and as the weaker price of Canadian heavy oil weighs. Canada’s benchmark crude oil trading at just $12.1 per barrel. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed