Dollar index trading at 97.13 (+0.17%)

Strength meter (today so far) – Aussie -1%, Kiwi -0.51%, Loonie -0.87%

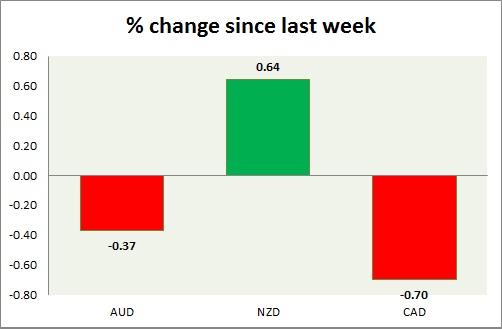

Strength meter (since last week) – Aussie -0.37%, Kiwi +0.64%, Loonie -0.70%

AUD/USD –

Trading at 0.727

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/buy

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732 (testing)

Economic release today –

- Q3 GDP slows to 2.8 percent y/y, down from 3.1 percent y/y in the last quarter.

Commentary –

- The Australian dollar is declining sharply after a failure to break the key resistance around 0.733 area and as the USD recovered. Weaker than expected Q3 GDP is also weighing on the Aussie.

NZD/USD -

Trading at 0.69

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.695 (testing)

Economic release today –

- NIL

Commentary –

- The New Zealand dollar is the best performer of the week as a stronger economy weighs over stronger USD. However, moving lower amid a stronger USD. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.337

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.33 (broken)

Economic release today –

- BoC kept the policy rate unchanged at 1.75 percent and issued warnings.

Commentary –

- Loonie is the worst performer of the week and as the weaker price of Canadian heavy oil weighs and BoC issued warning over the Canadian oil crisis. Canada’s benchmark crude oil trading at just $12.1 per barrel. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed