Dollar index trading at 96.67 (-0.31%)

Strength meter (today so far) – Aussie -0.13%, Kiwi -0.13%, Loonie -0.32%

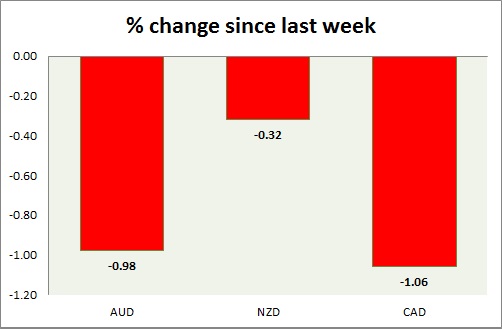

Strength meter (since last week) – Aussie -0.98%, Kiwi -0.32%, Loonie -1.06%

AUD/USD –

Trading at 0.71

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/buy

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732

Economic release today –

- Australian unemployment rate rose to 5.1 percent in November as participation rate rose to 65.7 percent. Employment rose by 37,000.

Commentary –

- The Australian dollar is sharply down this week.

NZD/USD -

Trading at 0.677

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.695

Economic release today –

- Credit card spending up 6.1 percent y/y.

Commentary –

- The New Zealand dollar remains upbeat as the economy remains robust but weakens this week on USD recovery. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.352

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.365, Medium term – 1.35, Short term – 1.35

Economic release today –

- CPI inflation up 1.7 percent from a year ago.

Commentary –

- Loonie is the worst performer of the week. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.