Dollar index trading at 96.40 (-0.53%)

Strength meter (today so far) – Aussie +0.37%, Kiwi +0.33%, Loonie +0.02%

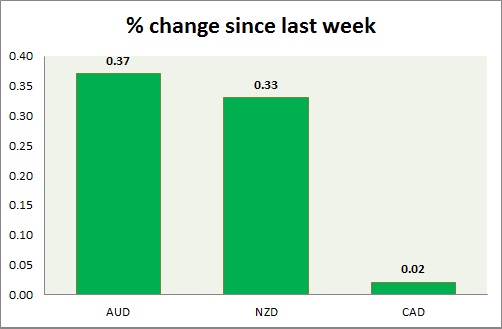

Strength meter (since last week) – Aussie +0.37%, Kiwi +0.33%, Loonie +0.02%

AUD/USD –

Trading at 0.706

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/sell

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71 (broken)

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732

Economic release today –

- Australian unemployment rate rose to 5.1 percent in November as participation rate rose to 65.7 percent. Employment rose by 37,000.

Commentary –

- The Australian dollar is sharply down this week. The worst performer of the week.

NZD/USD -

Trading at 0.673

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.695

Economic release today –

- NIL

Commentary –

- The New Zealand dollar remains upbeat as economy remains robust but weakens this week on USD recovery. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.359

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.365, Medium term – 1.35, Short term – 1.35

Economic release today –

- NIL

Commentary –

- Loonie is down on recovering dollar and weaker oil price.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX