Dollar index trading at 94.38 (-0.15%)

Strength meter (today so far) – Aussie -1.83%, Kiwi -0.56%, Loonie -0.12%

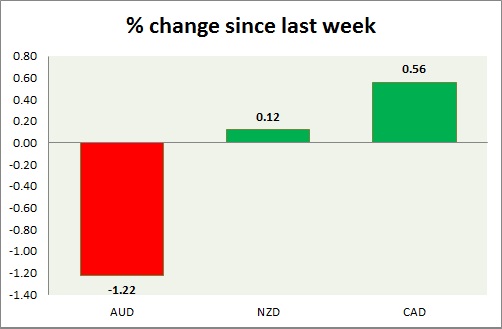

Strength meter (since last week) – Aussie -1.22%, Kiwi +0.12%, Loonie +0.56%

AUD/USD –

Trading at 0.76

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.742

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- CPI declined to 1.3% y/y in first quarter and RBA’s trimmed mean CPI declined to 1.7%, lowest since 1999.

Commentary –

- Aussie dropped sharply today after inflation unexpectedly dropped, providing room to cut rates.

NZD/USD –

Trading at 0.686

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- RBNZ will announce monetary policy at 21:00 GMT.

Commentary –

- Kiwi found support in rising trend line, focus is on FOMC and RBNZ.

USD/CAD –

Trading at 1.26

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- BOC governor Poloz is scheduled to speak at 12:40 GMT.

Commentary –

- Loonie is best performer this week as oil rise to new 2016 highs. All targets reached except 1.17 area, which may take a while and correction higher for the pair.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022