Dollar index trading at 96.06 (-0.09%)

Strength meter (today so far) – Aussie +0.00%, Kiwi +1.22%, Loonie +0.20%

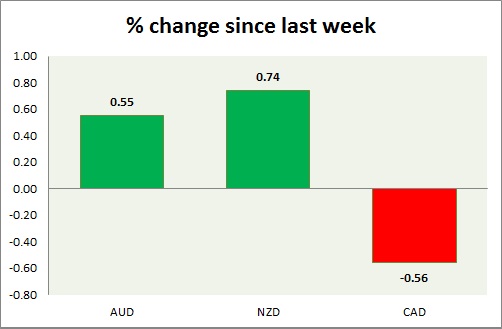

Strength meter (since last week) – Aussie +0.55%, Kiwi +0.74%, Loonie -0.56%

AUD/USD –

Trading at 0.751

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- NIL.

Commentary –

- Aussie is up on risk affinity. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.722

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL

Commentary –

- Kiwi turned best performer today and this week. Active call – Buy kiwi targeting 0.718 and the stop loss near 0.66

USD/CAD –

Trading at 1.294

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.32

Economic release today –

- Building permits data will be released at 12:30 GMT.

- IVEY PMI will be released at 14:00 GMT.

Commentary –

- Loonie recovered grounds on stronger oil price but still down for the week.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed