Dollar index trading at 99.29 (+0.32%).

Strength meter (today so far) - Aussie -0.33%, Kiwi -0.44%, Loonie -0.02%.

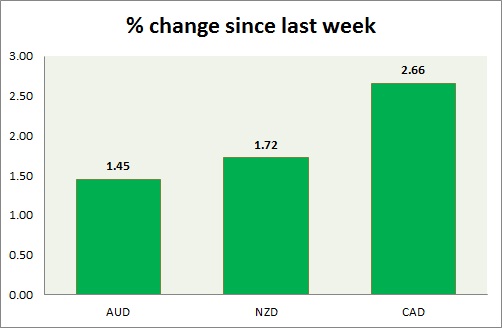

Strength meter (since last week) - Aussie +1.27%, Kiwi -0.26%, Loonie -0.79%.

AUD/USD -

Trading at 0.767

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.771-0.773

Economic release today -

- Investment lending for homes dropped -3.4% in February, however home loans grew 1.2% in February compared to -1.7% drop in January.

Commentary -

- Aussie remained the only currency among 7 closing in green against this week against dollar. RBA's less dovish tone is keeping it buoyant.

- Nevertheless, larger downtrend still remains intact.

NZD/USD -

Trading at 0.754

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.76-0.763

Economic release today -

- NIL

Commentary -

- Kiwi failed to gain above immediate resistance area mentioned above amid stronger dollar. Pair might keep struggling in coming days as larger bearish trend remains in play.

- Bearish doji with long upper shadow remains in focus in weekly chart. Very close to a grave stone doji. Bias is still downwards.

USD/CAD -

Trading at 1.258

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.243-1.24

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284, Immediate - 1.267-1.27

Economic release today -

- Housing starts grew faster in March. Employment increased by 28.7K, however unemployment rate remained same at 6.8%.

Commentary -

- Canadian dollar once again dropped from the resistance zone mentioned above, partial. It continue to move sideways. Partial profit booking should be done around such levels.

- Next week might provide guidance over next move, pair is lacking break out stimuli on either side.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?