Dollar index trading at 101.84 (-0.19%)

Strength meter (today so far) – Aussie +0.12%, Kiwi +0.31%, Loonie +0.09%

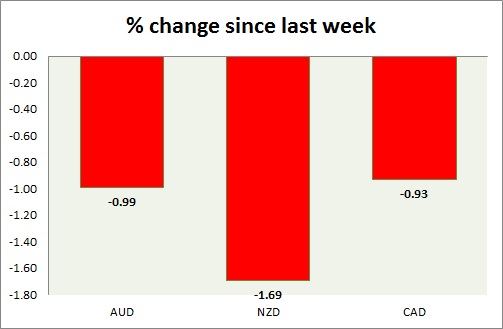

Strength meter (since last week) – Aussie -0.99%, Kiwi -1.69%, Loonie -0.93%

AUD/USD –

Trading at 0.752

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- NIL

Commentary –

- Aussie slid further and currently testing key support at 0.75 area. The decline in iron ore prices weighing on the Aussie. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.692

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- NIL

Commentary –

- Kiwi is threatening to break an important support around 0.69 area and it is the worst performer of the week so far. The New Zealand dollar might decline another 200 pips to test key support around 0.67 area.

USD/CAD –

Trading at 1.349

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- New house price index for January will be updated at 13:30 GMT.

Commentary –

- Loonie is hovering around its key support around 1.35 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022