Dollar index trading at 94.96 (+0.33%)

Strength meter (today so far) – Aussie -0.28%, Kiwi +0.03%, Loonie -0.24%

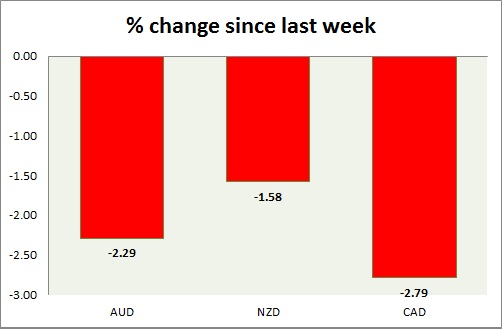

Strength meter (since last week) – Aussie -2.29%, Kiwi +0.39%, Loonie -2.82%

AUD/USD –

Trading at 0.763

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.77

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8

Economic release today –

- Producer price index is up 0.2 percent q/q in the third quarter, up 1.6 percent from a year ago

Commentary –

- Aussie is down this week on weaker than expected economic data, recovering dollar, and weaker commodity price.

NZD/USD –

Trading at 0.684

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.69

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- NIL

Commentary –

- Kiwi is declining steadily since the government change.

USD/CAD –

Trading at 1.268

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/sell

Support –

- Long term – 1.2, Medium term – 1.2, Short term – 1.22

Resistance –

- Long term – 1.27, Medium term – 1.25, Short term – 1.25 (broken)

Economic release today –

- NIL

Commentary –

- Loonie is the worst performer of the week on NAFTA tension and dovish BoC.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022