Dollar index trading at 94.60 (-0.12%)

Strength meter (today so far) – Aussie -0.52%, Kiwi +0.36%, Loonie +0.60%

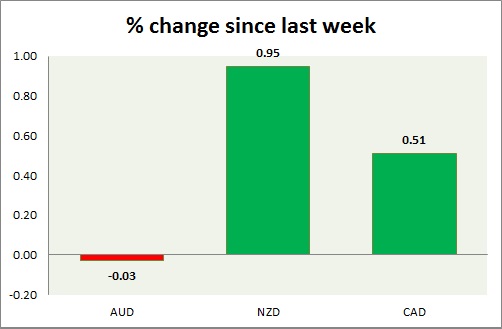

Strength meter (since last week) – Aussie -0.03%, Kiwi +0.95%, Loonie +0.51%

AUD/USD –

Trading at 0.767

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765 (testing), Short term – 0.77 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8

Economic release today –

- No growth in retail sales for the month of September.

Commentary –

- Aussie is the worst performer of the week among commodity pairs. .Weaker iron ore price is taking a toll on Aussie amid political turmoil.

NZD/USD –

Trading at 0.69

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.68

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- NIL

Commentary –

- Kiwi is up on better than expected unemployment report.

USD/CAD –

Trading at 1.284

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.3

Economic release today –

- September trade balance came at $3.18 billion.

- October job creation at 35,300. The unemployment rate edged up to 6.3 percent as participation increased by 0.1 Percent.

Commentary –

- Loonie recovered from an earlier loss on higher oil price.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX