Dollar index trading at 94.28 (-0.26%)

Strength meter (today so far) – Euro +0.50%, Franc +0.18%, Yen -0.09%, GBP -0.20%

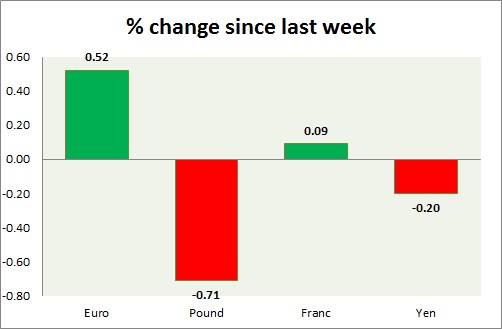

Strength meter (since last week) – Euro +0.52%, Franc +0.09%, Yen -0.20%, GBP -0.71%

EUR/USD –

Trading at 1.172

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.16 (broken)

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.2

Economic release today –

- GDP rose 0.6 percent in the third quarter, up 2.5 percent from a year ago.

- Industrial production down 0.6 percent in September, up 3.3 percent from a year ago.

Commentary –

- The euro is the best performer of the week. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.309

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.313 (testing)

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.36

Economic release today –

- UK inflation report for October showed, RPI up 4 percent y/y, HPI up 5.4 percent y/y, PPI output up 2.8 percent y/y, PPI input up 4.6 percent y/y, CPI up 3 percent y/y, and core CPI up 2.7 percent y/y.

Commentary –

- The pound is the worst performer of the day and week as political tensions brew within the Conservative Party as reports surface that 40 MPs are ready to sign no confidence against Prime Minister May. Weaker than expected inflation is also taking a toll on pound.

USD/JPY –

Trading at 113.7

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Third quarter GDP number will be released at 23:50 GMT.

Commentary –

- The yen is marginally weak this week. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.995

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- Producer and import price index up 0.5 percent in August, up 1.2 percent from a year ago.

Commentary –

- Franc is a much worse performer than the euro this week. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX