Dollar index trading at 93.80 (-0.11%)

Strength meter (today so far) – Euro +0.08%, Franc +0.20%, Yen +0.57%, GBP -0.02%

Strength meter (since last week) – Euro +0.52%, Franc +0.09%, Yen -0.20%, GBP -0.71%

EUR/USD –

Trading at 1.179

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.2

Economic release today –

- Current account in September came at €37.8 billion.

- Construction output down 0.1 percent in September, up 3.1 percent from a year ago.

Commentary –

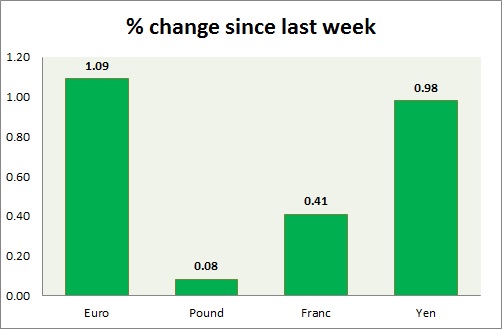

- The euro is the best performer of the week on better economic outlook as the German GDP beats forecast and as dollar declines on Washington politics. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.32

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.313 (testing)

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.36

Economic release today –

- NIL

Commentary –

- The pound is the worst performer of the day and week as political tensions brew within the Conservative Party as reports surface that 40 MPs are ready to sign no confidence against Prime Minister May. Weaker than expected inflation is also taking a toll on pound. However, it is holding on to support around 1.308 area and positive for the week.

USD/JPY –

Trading at 112.3

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- NIL

Commentary –

- The yen is higher this week on risk aversion as equities slide. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.991

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is a much worse performer than the euro this week. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022