Dollar index trading at 93.28 (+0.07%)

Strength meter (today so far) – Euro +0.04%, Franc -0.11%, Yen +0.05%, GBP +0.31%

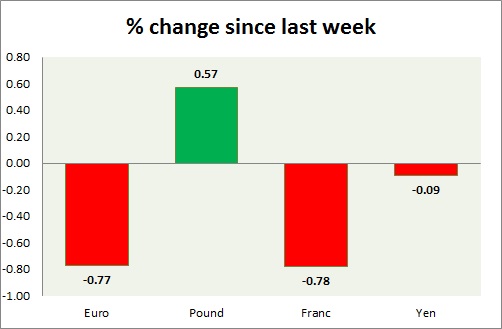

Strength meter (since last week) – Euro -0.77%, Franc -0.78%, Yen -0.09%, GBP +0.57%

EUR/USD –

Trading at 1.184

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.2

Economic release today –

- Eurozone consumer confidence improves to 0.1 in November.

- Services sentiment rose to 16.3

- Industrial confidence rose to 8.2

- Economic sentiment improves to 114.6

- Business climate improves to 1.49

Commentary –

- The euro is down this week as the dollar recovers. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.34

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.32

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.35

Economic release today –

- BRC shop price shop price down 0.1 percent y/y in October.

- Net lending to individuals in October stood at £4.8 billion.

- M4 money supply up 0.6 percent in October, up 4.1 percent from a year ago.

Commentary –

- The pound is the best performer of the week.

USD/JPY –

Trading at 111.6

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- October industrial production report will be released at 23:50 GMT.

Commentary –

- The yen is marginally down this week due to lack of risk aversion. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.985

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- Zew survey expectations improve to 40.7 in November.

Commentary –

- Franc is the worst performer this week. Active call – Buy pair targeting 1.02

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022