Dollar index trading at 94.44 (-0.01%)

Strength meter (today so far) – Euro +0.04%, Franc -0.22%, Yen -0.20%, GBP +0.16%

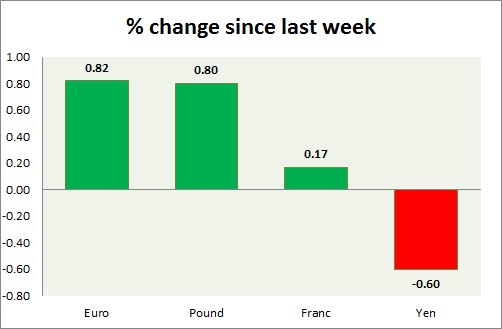

Strength meter (since last week) – Euro +0.82%, Franc +0.17%, Yen -0.60%, GBP +0.80%

EUR/USD –

Trading at 1.184

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.2

Economic release today –

- October current account balance came at €30.8 billion.

Commentary –

- The euro is up this week as the dollar remains weak over Tax proposal concerns. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.341

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.32

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.35

Economic release today –

- CBI distributive trade survey came at 20 percent in December.

Commentary –

- The pound retraced earlier gains over Brexit trade talk concerns. It is up in line with the euro.

USD/JPY –

Trading at 113.3

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- NIL

Commentary –

- The yen is the worst performer this week as equities continue to rise. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.988

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is a much weaker performer than the euro this week. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed