Dollar index trading at 93.32 (-0.24%)

Strength meter (today so far) – Euro +0.17%, Franc +0.10%, Yen +0.22%, GBP +0.34%

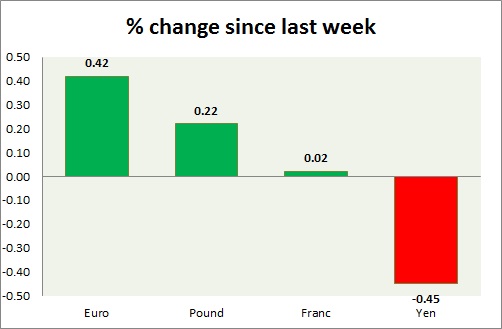

Strength meter (since last week) – Euro +0.42%, Franc -0.29%, Yen -0.91%, GBP +0.22%

EUR/USD –

Trading at 1.182

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.12, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.25, Medium term – 1.22, Short term – 1.2

Economic release today –

- ECB will announce rate decision at 11:45 GMT, followed by a press conference at 12:30 GMT.

Commentary –

- The euro remains upbeat heading to ECB meeting. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.14; likely to correct towards 1.2 area

GBP/USD –

Trading at 1.342

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.32, Medium term – 1.35, Short term – 1.35 (broken)

Resistance –

- Long term – 1.425 Medium term – 1.39, Short term – 1.37

Economic release today –

- Retail sales grew 1.3 percent in May, up 3.9 percent from a year ago.

Commentary –

- The pound recovered earlier loss on a weaker dollar. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.3

USD/JPY –

Trading at 110

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 101, Medium term – 104.2, Short term – 106.2

Resistance –

- Long term – 111, Medium term – 109, Short term – 109 (broken)

Economic release today –

- Industrial production up 2.6 percent y/y in April.

Commentary –

- The yen is the worst performer of the week but recovering grounds as equities slide.

USD/CHF –

Trading at 0.984

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- Fourth quarter industrial production up 9 percent y/y.

- Producer and import price inflation up 3.2 percent.

Commentary –

- Franc is a much weaker performer than the euro this week.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed