Dollar index trading at 95.08 (-0.10%)

Strength meter (today so far) – Euro +0.02%, Franc +0.07%, Yen +0.27%, GBP -0.08%

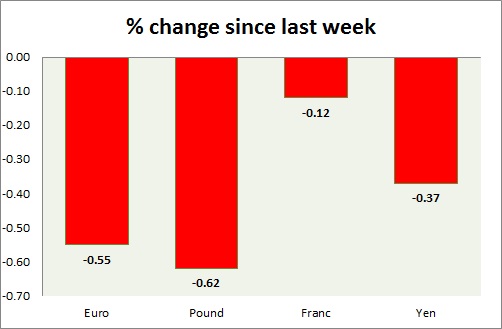

Strength meter (since last week) – Euro -0.55%, Franc -0.12%, Yen -0.37%, GBP -0.62%

EUR/USD –

Trading at 1.159

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.12, Medium term – 1.145, Short term – 1.145

Resistance –

- Long term – 1.22, Medium term – 1.2, Short term – 1.18

Economic release today –

- Markit services PMI declined to 54.2 in July.

- Retail sales up 1.2 percent y/y in June.

Commentary –

- The euro is consolidating in a range of 350 pips since May. The consolidation continuing even after ECB. Down this week, as the dollar recovers on hawkish FOMC. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095

GBP/USD –

Trading at 1.30

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.24, Medium term – 1.27, Short term – 1.3

Resistance –

- Long term – 1.37 Medium term – 1.35, Short term – 1.33

Economic release today –

- Services PMI declined to 53.5 in July.

Commentary –

- The pound is down this week on hawkish FOMC and dovish BoE. Active call- short-term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25

USD/JPY –

Trading at 111.4

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 104.2, Medium term – 106.2, Short term – 109.2

Resistance –

- Long term – 114, Medium term – 111, Short term – 111

Economic release today –

- Markit services PMI declined to 51.3 in July.

Commentary –

- The yen is trying to recover on risk aversion as equities slide, however, stronger dollar and dovish BoJ weighs.

USD/CHF –

Trading at 0.995

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- CPI inflation rose to 1.2 percent y/y in July.

Commentary –

- Franc is a slightly better performer than the euro this week.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed