Dollar index trading at 95.16 (-0.02%)

Strength meter (today so far) – Euro -0.03%, Franc -0.27%, Yen -0.23%, GBP -0.02%

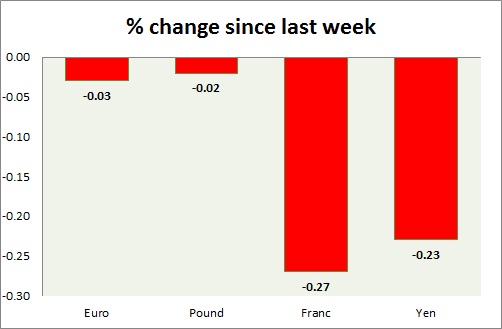

Strength meter (since last week) – Euro -0.03%, Franc -0.27%, Yen -0.23%, GBP -0.02%

EUR/USD –

Trading at 1.16

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support

- Long term – 1.10, Medium term – 1.12, Short term – 1.15

Resistance –

- Long term – 1.22, Medium term – 1.18, Short term – 1.18

Economic release today –

- Markit manufacturing PMI declined to 53.2 in September from 52.2 in August.

- Unemployment rate declined to 8.1 percent in August.

Commentary –

- The euro is giving up earlier gains as the USD gains post-FOMC. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095; Euro might correct towards 1.22 area

GBP/USD –

Trading at 1.302

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.19, Medium term – 1.23, Short term – 1.285

Resistance –

- Long term – 1.35 Medium term – 1.32, Short term – 1.32

Economic release today –

- Manufacturing PMI rose to 53.8 in September.

- M4 money supply up 1.2 percent y/y

Commentary –

- The pound is down in line with the euro. The focus in turning on Brexit. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25

USD/JPY –

Trading at 113.9

Trend meter -

- Long term – Sell, Medium term – buy, Short term – Range/Buy

Support –

- Long term – 106.2, Medium term – 109.2, Short term – 111

Resistance –

- Long term – 117, Medium term – 114, Short term – 114

Economic release today –

- Manufacturing PMI declined to 52.5 in September from 52.9.

Commentary –

- The yen remains trapped in bull/bear fight amid risk aversion and strong dollar. Weakening since last week on strong dollar.

USD/CHF –

Trading at 0.983

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 0.98 (testing)

Economic release today –

- Real retail sales up 0.3 percent y/y in August.

- PMI declined to 59.7 in September.

Commentary –

- Franc is down in line with the yen.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022