Dollar index trading at 99.91 (+0.10%)

Strength meter (today so far) – Euro +0.17%, Franc -0.18%, Yen -0.02%, GBP -0.82%

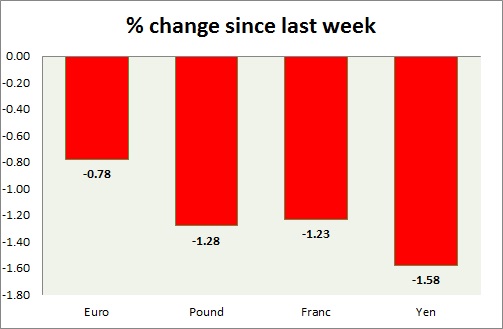

Strength meter (since last week) – Euro -0.78%, Franc -1.23%, Yen -1.58%, GBP -1.28%

EUR/USD –

Trading at 1.076

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.054

Resistance –

- Long term – 1.13, Medium term – 1.11, Short term – 1.09

Economic release today –

- Trade balance for September came at €24.9 billion.

- Third quarter GDP grew by 0.3 percent in the second quarter up 1.6 percent from a year ago.

- Zew survey economic sentiment improved to 15.8 in November.

Commentary –

- The euro has broken below a major support around 1.08 area, likely to decline further. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.242

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Retail price index grew 2 percent in November from a year ago.

- House price index is up 7.7 percent y/y in September.

- Producer price index input is up 12.2 percent y/y in October.

- Consumer price index up 0.9 percent y/y in October.

- Producer price index output is up 2.1 percent y/y.

Commentary –

- The pound has started declining against the dollar. The pound has reached our target 1.2 area. We expect the pound to reach parity.

USD/JPY –

Trading at 108.2

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 103

Resistance –

- Long term – 111, Medium term – 111, Short term – 111

Economic release today –

- NIL

Commentary –

- The yen is the worst performer of the week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar.

USD/CHF –

Trading at 0.998

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.995

Economic release today –

- NIL

Commentary –

- Franc is continuing its testing of the parity. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term. However, this call is under threat currently. We could soon revise the call.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed