Dollar index trading at 100.41 (+0.18%)

Strength meter (today so far) – Euro -0.32%, Franc -0.12%, Yen +0.24%, GBP +0.10%

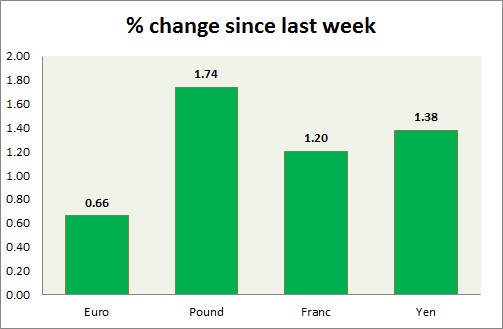

Strength meter (since last week) – Euro +0.66%, Franc +1.20%, Yen +1.38%, GBP +1.74%

EUR/USD –

Trading at 1.074

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.09, Medium term – 1.075, Short term – 1.072

Economic release today –

- Trade balance for January came at €20 billion.

- Construction output is down 3.3 percent y/y in January.

Commentary –

- The euro is up on the dollar after FOMC and Dutch election but the worst performer among other majors.

GBP/USD –

Trading at 1.236

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25

Economic release today –

- BoE released quarterly bulletin.

Commentary –

- MPC member Kristine Forbes vote to hike rates has pushed the pound to be the best performer of the week. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.1

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 112

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- NIL

Commentary –

- The yen strengthened as the dollar weakened post FOMC. Active call – Yen likely to reach 120 as key support broken.

USD/CHF –

Trading at 0.997

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is a top performer of the week as SNB adds hawkish comments in the monetary policy statement and due to a weaker dollar. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX