Dollar index trading at 96.95 (+0.26%)

Strength meter (today so far) – Euro -0.24%, Franc -0.22%, Yen -0.20%, GBP -0.17%

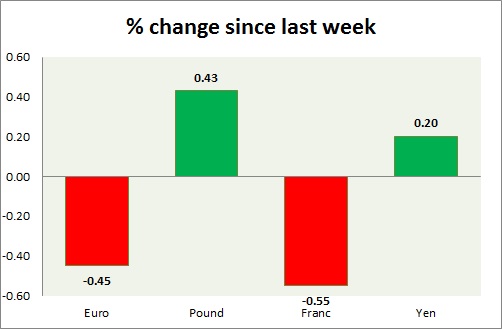

Strength meter (since last week) – Euro -0.45%, Franc -0.55%, Yen +0.20%, GBP +0.43%

EUR/USD –

Trading at 1.123

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.07, Medium term – 1.09, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.14, Short term – 1.14

Economic release today –

- In the first quarter, GDP grew by 0.6 percent, up 1.9 percent from a year ago.

- ECB kept interest rates unchanged at today’s meeting.

- Mario Draghi’s press conference scheduled at 12:30 GMT.

Commentary –

- The euro is consolidating above 1.12 area, ahead of a press conference by Mario Draghi.

GBP/USD –

Trading at 1.294

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- The UK is holding the general election today.

Commentary –

- The pound is the best performer of the week so far. The focus is on today’s general election. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 110.1

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 109, Short term – 110 (broken)

Resistance –

- Long term – 119, Medium term – 115, Short term – 113

Economic release today –

- NIL

Commentary –

- The yen gave up most of the gains as risk aversion subsides.

USD/CHF –

Trading at 0.967

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.98

Economic release today –

- Unemployment rate for May came at 3.2 percent.

Commentary –

- Franc is down in line with the euro. The worst performer of the week so far. It is heading for a test of 0.95 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed