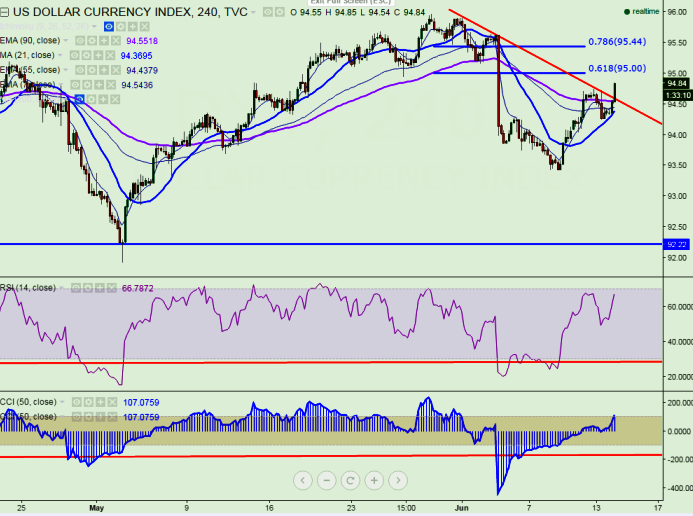

- Short term trend - Bullish

- Major resistance- 94.60 ( trend line joining 95.90 and 95.64)

- Major support – 94 (4H Kijun-Sen)

- US dollar index has broken major trend line resistance at 94.60 and jumped till 94.72. It is currently trading at 94.71.

- Short term trend is bullish as long as support 94 holds. On the lower side any break below 94.50 (90 4H EMA) will drag the index down till 94.25/94. Extreme weakness can be seen only below 93.40.

- On the higher side any violation above 94.60 will take the DXY to next immediate resistance 95/95.50/96.

It is good to buy at dips around 94.75 with SL around 94.25 for the TP of 95.50/96

R1-95

R2-95.45

R3-96

Support

S1-94.25

S2-94

S3-93.40