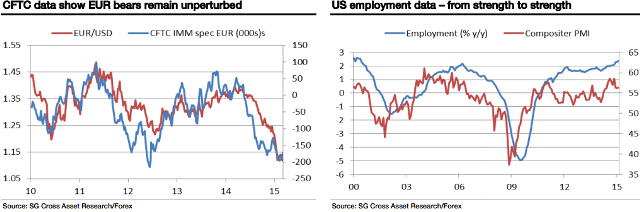

The dollar made new highs and the Euro new multi-year lows after Friday's strong non-farm payroll gains.

As of last Tuesday, CFTC data show speculative positions on the IMM remained very short of the Euro, and long of the dollar but concerns about positioning have been swept aside and the dollar's advance goes on.

The pace of employment growth has picked up to 2.4%, the strongest since the dotcom bubble was in full bloom. Employment growth is a lagging indicator and the last time it was this strong, the ISM release was just about to start sliding, but 2.4% y/y NFP gains added to wage growth of 2%, is strong enough to maintain the FOMC's timetable towards a mid-year rate hike.

Societe Generale notes as follows on Monday:

- Policy doves will argue that there is no inflationary pressure in prices or wages, but while that would be relevant if rates were at 2%, it is irrelevant now.

- Wage growth of 2% (or even 1.6% as measured by the non-supervisory series points at best to a sideways trend.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed