“When will driverless cars be out on the streets?” I’m often asked this question and I usually refrain from answering it. Before we ask when, we should ask ourselves what do we need from autonomous vehicles?

One answer is “suburban mobility”. It’s among the most critical challenges we face in Australian cities, and automated vehicles could offer a solution.

In particular, automated services – either expanded and frequent fixed-route services feeding major transit hubs, or flexible mobility-on-demand door-to-door trips – could stop the downward spiral of suburban public transport.

Reviving suburban bus services

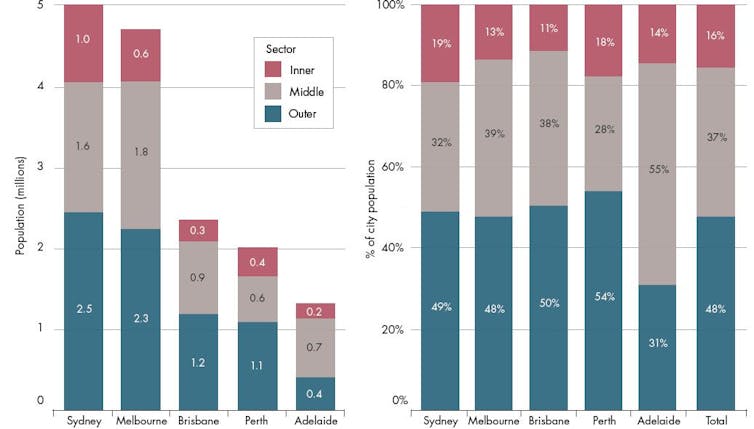

Australia’s population is expected to grow by 50% over the next 30 years. Much of this growth will be in the outer suburbs of capital cities. Almost half of our population already lives in these suburbs.

Estimated resident population by sector, as count and proportion of city population, 2016. Infrastructure Australia 2018, CC BY

Given the growth of the suburbs, efficient mobility in these areas is essential for economic growth on par with the population. The future sustainability and livability of our cities also depend on efficient mobility options.

A 2018 Infrastructure Australia report identified the inefficiency and shortage of public transport in our suburbs as a problem.

At present, as a result of inadequate public transport and car-oriented developments, suburban residents depend heavily on private cars. Combined with rapid suburban growth, the heavy reliance on cars will lead to massive increases in traffic congestion and delays. This will cause heavy economic and environmental costs.

An effective public transport system can curb the dominance of private cars and serve as a competitive alternative that can meet our future mobility needs more sustainably and equitably. Frequent and accessible bus services in expanded suburbs, including connections to the rail network, are essential. At present, public transport is used for only about 5% of trips by suburban households.

Small driverless buses can provide connections to train services, as in the case of this trial at Tonsley station, Adelaide.

A problem of costs

The problem is that suburban bus services typically fail to recover their operating costs from fare revenue. This is due to sparse ridership, longer travel distances and, most importantly, labour-intensive bus operations.

As a result, these services are uneconomical, often scarce, and depend heavily on government subsidies. Rising labour costs and worsening traffic congestion (leading to more driver hours required for the same service) mean bus operation becomes increasingly expensive.

Metropolitan and outer metropolitan bus cost recovery, Sydney, 2008–12. Infrastructure Australia, 2018, CC BY

Budget deficits can trigger service cuts and fare hikes, which in turn lead to ridership declines and further revenue losses. We see this “downward spiral” for bus services around the world (for examples, see here, here, and here).

A comprehensive analysis of 25 North American cities found a sharp decline in public transport ridership over the past few years. This was mainly due to reduced bus services.

Without significant interventions, growing suburban populations will be either forced to drive or excluded from societal opportunities.

Autonomous opportunity

Automated vehicle technology presents an unprecedented opportunity to transform the suburban public transport system into an effective substitute for private cars.

We can expect 40-60% savings in operational costs from driverless buses. With options of smaller vehicles and larger fleets of automated buses and shuttles, public authorities could afford to deliver more frequent, flexible services to a wider suburban area.

Such improvements would reduce passenger waiting times and walking distances – the main deterrents for users – and so could increase ridership and revenue. These outcomes can create a virtuous cycle for suburban services, leading potentially to self-sufficiency for suburban public transport.

In 2015, the Bureau of Infrastructure, Transport and Regional Economics (BITRE) estimated the societal costs of traffic congestion in Australian major cities at A$16.5 billion a year. This was projected to reach A$27 billion to A$37 billion by 2030. Automated vehicles could lower this cost.

A well-connected network can encourage people to give up private cars for public transport. Autonomous vehicles can be used to make suburban bus services more frequent and accessible, providing mobility for a growing suburban population that is prone to car-dependency. These bus services can improve connectivity to rail and give individuals access to economic opportunities, education, health care and social activities without having to drive.

So when will these buses be on our streets?

Automated buses have been tested in real-world trials to identify and overcome barriers to deployment, including safety, technology and legal issues. Most of these have been in Europe, but Australia has had several trials in Adelaide, as well as in Perth, Melbourne, Sydney, Brisbane, Darwin, Canberra and a few regional centres.

The first driverless bus trial in New South Wales was at Olympic Park, Sydney.

These trials clearly demonstrate that, given adequate planning and investment, fully automated buses – particularly those running on fixed routes and dedicated lanes – can operate commercially now. Flexible-route, automated services mixed with regular traffic may take longer to become a reality.

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings