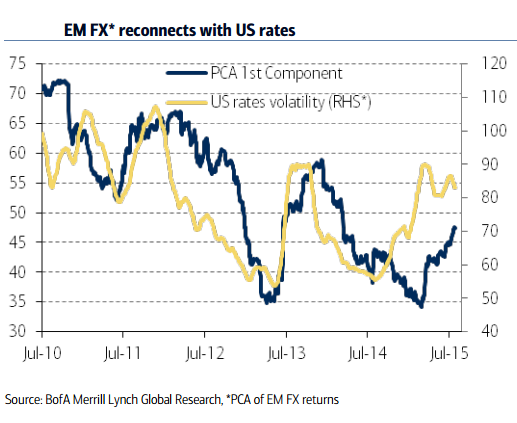

After a brief period of exuberance sparked by ECB announcing its QE program in early 2015, EM FX behavior is increasingly re-coupling with US rates volatility. A breakdown of key EM FX returns suggests that the proportion of returns explained by one common component (PCA) has increased again. It is now 45-50% and rising as it catches up to persistent concerns around the Fed timing and path. Will US rates volatility persist? Both in 1999 and 2004, US rates volatility - as measured by the MOVE index - stabilized/declined after the first hike. In 1994, however, it increased. The behaviour of rates volatility remains a risk and dependent on Fed signals, but it is worth noting that in 1999 and 2004, volatility was up in the six months leading the first hike, as it is now, rather than down like in 1994. A gradual Fed path, a decline in uncertainty and volatility could help EM as it did post tapering in 2014. However, this remains a tail risk.

EM reconnects with US rates volatility

Thursday, August 6, 2015 9:02 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022