This week, Ethereum spot ETFs are seeing once more considerable positive inflows, indicating ongoing corporate interest in the asset. Following billions in recent months and a small outflow at the beginning of August, new capital totaling tens of millions daily has begun pouring into these ETFs. Along with the Ethereum Foundation Treasury's holdings, this consistent demand now makes up about 3.2% of the overall ETH supply, therefore confirming Ethereum's solid market position.

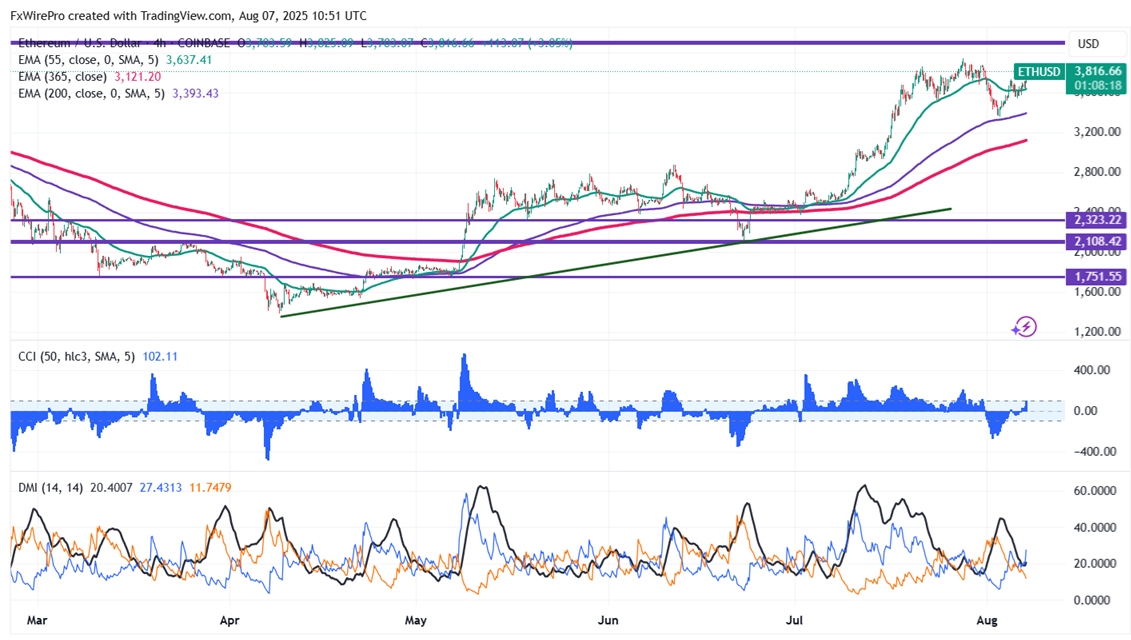

ETHUSD broke significant resistance $3737 after a minor consolidation. It hits an intraday high of $3825 and is currently trading around $3814. Overall trend remains bullish as long as support $2000 remains intact. Watch out for $4000, any break above targets $5000. A robust bullish trend will only materialize above $5000.

Immediate support is around $3550. Any violation below will drag the price down to $3500/$3380/$3200/$3000. A breach below $3000 could see Ethereum plummet to $2770/$2500.

It is good to buy on dips around $3700 with SL around $3500 for a TP of $4100/$5000.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary