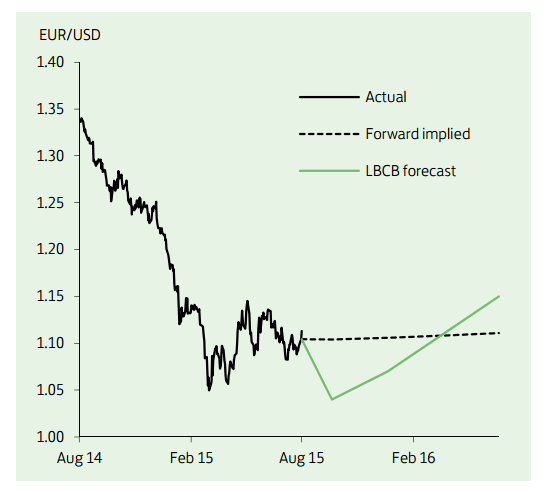

Having been confined to a range of 1.0850-1.11 for much of the month, the EUR broke higher following the surprise devaluation of the Chinese Yuan - rising to a 5-week high above 1.12. The spike higher was largely attributed to position squaring amid heightened global market volatility. More generally, the euro was underpinned over the month by continued progress towards a third Greek bailout.

"We maintain our long-term view that EUR/USD still looks undervalued at these levels," notes Lloyds Bank.

A fading of euro area risk premia, a steady and more sustained upturn in euro area growth and an eventual winding down of QE in 2016 should see the euro post a more sustained improvement in due course. For now, however, it is believed that the single currency remains vulnerable to renewed weakness if, as expected, the Fed raises interest rates next month. Amid rumours that snap elections may be called, Greece's third bailout remains subject to significant implementation risk. EUR/USD is expected to drop to 1.04 by the end of Q3. But in the absence of a renewed conflagration in peripheral markets, a move down towards parity should mark the low.

EUR/USD Outlook

Wednesday, August 12, 2015 8:54 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX