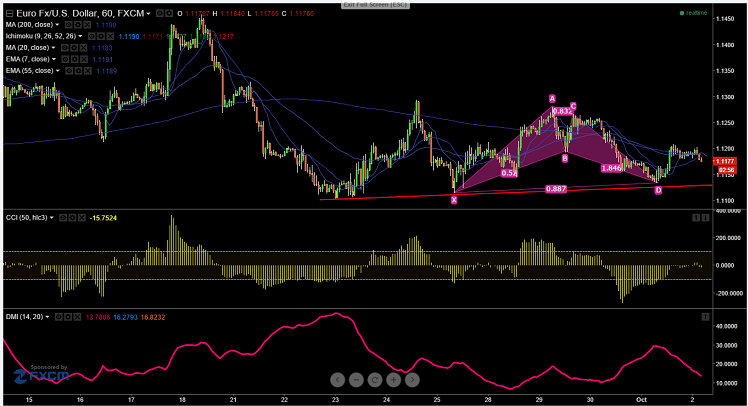

Harmonic pattern formed -Bullish BAT Pattern

Potential Reversal Zone (PRZ)- 1.1125

- EUR/USD has declined till 1.11338 and slightly recovered till 1.20690 from that level. It is currently trading at 1.11790.

- Market awaits US NFP for further direction.Non-farm payroll is expected to show 200k growth in September compared to 173k in August.

- The pair's short term support is around 1.125 (trend line joining 1.1104 and 1.11150) and any break below targets 1.1080/1.1100.

- The pair's intraday resistance is around 1.122 and any break above targets 1.1265/1.128/1.1270.

- Short term bullishness only above 1. break above 1.1300 will take the pair to next target to 1.1340/1.1370.

It is good to buy at dips 1.1125-30 with SL around 1.1108 for the TP of 1.122/1.1270.