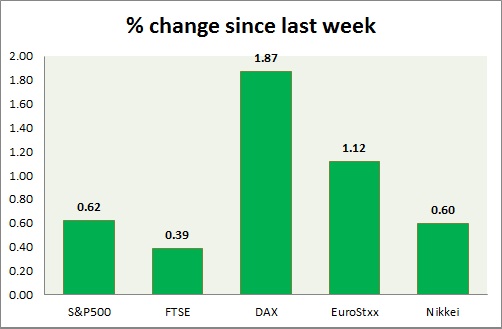

Equities are all trading in green today, as risk aversion from last week failed to gain traction this week and subsided. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark has only gained 1% so far this year, as investors remain worried about rate hike by FED and higher dollar putting pressure on company's revenue.

- Chicago FED national activity index came at -0.42, compared to prior-0.18.

- S&P 500 is currently trading at 2096, down +0.63% today. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE gained back above 7000 area, currently trading at 7030, up 0.50% today.

- Further rise can't be ruled out as FTSE continue to benefit from loose monetary policies.

- Important support lies at 6950, 6700.

DAX -

- DAX is up today, however last week's massive sell off crated bearish engulfing candle, which pose doubts over bulls' ability to move on at least for now.

- Index is trading at 11874, up nearly 1.6% today. Immediate support lies at 11600 and resistance at 12000

EuroStxx50 -

- Stocks across Europe gained back grounds lost last week except in Spain.

- Germany is up (+1.6%), France's CAC40 is up (+0.46%), Italy's FTSE MIB is up (+0.66%) and Spain's IBEX is down (-0.1%).

- EuroStxx50 is currently trading at 3712, up +1.20% today. Broader trend remains upwards. However index might drop lower in short term. Support lies at 3635, 3545, 3300

Nikkei -

- Nikkei bulls failed to push the index above 20000 level last week amid risk aversion and profit bookings at record level.

- Nikkei is currently trading at 19680. Immediate support lies at 19450, 18540 and resistance at 20000, 20800.

|

S&P500 |

+0.62% |

|

FTSE |

+0.39% |

|

DAX |

+1.87% |

|

EuroStxx50 |

+1.12% |

|

Nikkei |

+0.60% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings