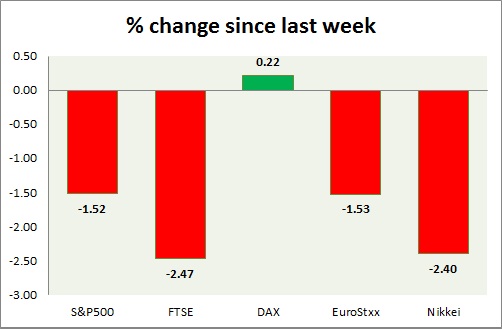

Equity performance is mixed today as it seems risk aversion is abating. Performance this week at a glance in chart & table -

S&P 500 -

- S&P gained back some grounds lost yesterday. Federal Reserve chair Janet Yellen warned against high equity valuations.

- Initial jobless claims rose by 3000 to 265,000. Continuing claims dropped to 2.2228 million from prior 2.253 million.

- S&P 500 is currently trading at 2076, down -0.2% today. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE is down further as election uncertainty unsettles investors booking profits. FTSE is worst performer so far this week.

- Historically speaking FTSE usually shrugs off election related uncertainty. In fact FTSE might move up rapidly once the uncertainty settles down and policy path clears up, freeing up awaiting investments.

- FTSE is currently trading at 6890, down -0.6% today. Immediate support lies at 6700.

DAX -

- DAX is trading in green today, massive selloff takes pause before NFP report tomorrow.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart provided the necessary strength to bears.

- German factory orders grew 0.9% in March, lower than expected 1.5%.

- DAX is currently trading at 11406, up about 0.5% today. Immediate support lies at 10550 and resistance at 11740, 12080 around. 11000 area might provide psychological support.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is up (+0.5%), France's CAC40 is down (-0.33%), Italy's FTSE MIB is down (-0.26%) and Spain's IBEX is down (-0.56%).

- French trade balance deteriorated to € -4.6 billion in March from €-3.6 billion in April.

- Bears remain in control, however strength seems to be fading a little.

- EuroStxx50 is currently trading at 3540, down -0.08% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei opened in deep negative territory after long holiday. However after hour future is indicating further sell off.

- Japanese services PMI moved to expansionary zone in April at 51.3.

- Nikkei is currently trading at 19243, further downside is likely. Price target is coming close to 17800.

- Key support is at 18900, 18400 and resistance at 19750 area.

|

S&P500 |

-1.52% |

|

FTSE |

-2.47% |

|

DAX |

+0.22% |

|

EuroStxx50 |

-1.53% |

|

Nikkei |

-2.40% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary