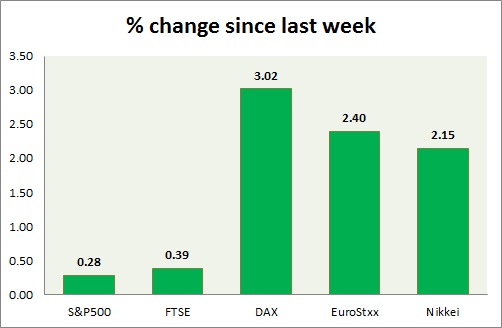

Equities are mostly flat today, after yesterday's massive buying. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is trading low volatility and gradually moving upwards. Risk remain significant over upcoming FED hike.

- MBA mortgage application dropped by -1.5%.

- S&P 500 is currently trading at 2129. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE bulls are struggling to push above 7000 mark. Further rise is likely.

- FTSE is currently trading at 7002. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is down today mostly over profit booking.

- Larger buy trend is have resumed. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11815. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is down (-0.33%), France's CAC40 is down (-0.26%), Italy's FTSE MIB is down (-0.02%) and Spain's IBEX is up (+0.31%).

- EuroStxx50 is currently trading at 3668, up 0.2% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei is the best performer today. Japanese GDP likely to have grown by 2.4% annualized rate at first quarter.

- Nikkei is currently trading at 20208. Key support is at 19500, 19000 and resistance at 20300 area.

|

S&P500 |

+0.28% |

|

FTSE |

+0.39% |

|

DAX |

+3.02% |

|

EuroStxx50 |

+2.40% |

|

Nikkei |

+2.15% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary