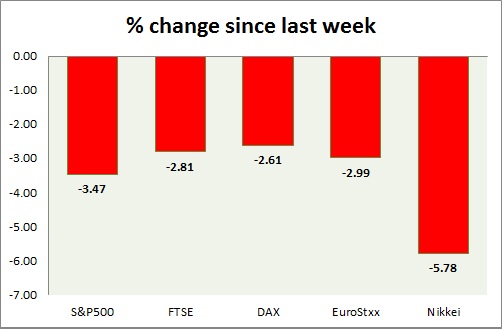

Equities are again trading in red today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P future up as risk aversion failed to gain traction, however gains are only marginal. Today's range 1910-1944.

- ADP employment report registered job gains of 190,000 in August, better than prior but lower than estimate.

- Non-farm productivity rose 3.3% in second quarter, while unit labor costs dropped by -1.4%

- S&P 500 is currently trading at 1922. Immediate support lies at 1900 and resistance 1960.

TSE -

- FTSE lost initial gains as equities lost ground globally. Today's range 6165-6000.

- FTSE is currently trading at 6060. Immediate support lies at 5950 and resistance 6600.

DAX -

- DAX gave up earlier gains, in line with global stocks. Today's range 9920-10125.

- DAX is currently trading at 10020. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is up (+0.32%), France's CAC40 is up (+0.53%), Italy's FTSE MIB is up (+0.12%), Portugal's PSI 20 is down (-0.6%), Spain's IBEX is down (-0.11%).

- Euro zone unemployment rate dropped to 10.9%, lowest in more than 3 years.

- EuroStxx50 is currently trading at 3184, up by +0.90% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei is worst performer this week as stronger Yen is providing headwinds. Today volatility is low in comparison. Today's range 18480-17800

- Nikkei is currently trading at 18050, with support around 16000 and resistance at 19500.

|

S&P500 |

-3.47% |

|

FTSE |

-2.81% |

|

DAX |

-2.61% |

|

EuroStxx50 |

-2.99% |

|

Nikkei |

-5.78% |

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’