In the week ending July 2, 2025, Spot Ethereum ETFs saw large inflows between 93,427 and 106,000 ETH, or over $260 million, which marked the seventh straight week of positive flows. Daily inflows, which include 12,455 ETH on July 1 alone and $150 million across three successive days, further show this constant institutional demand, with BlackRock's iShares Ethereum Trust spearheading the way. These strong inflows, which total $1. 17 billion in June 2025, highlighting increased institutional interest in Ethereum, motivated by stories about tokenization, stablecoins, and novel financial products.

With Ethereum ETFs possibly drawing up to $10 billion, Bitwise leaders—most specifically CIO Matt Hougan—expect significant inflows into crypto ETFs during the last half of 2025. Growing institutional adoption, the growing story around tokenized stocks and stablecoins on Ethereum, and recent regulatory clarification regarding staking all contribute to this optimistic projection. With $1. 17 billion in June 2025 and consistent inflows in five of the first six months of the year, Ethereum ETFs have already shown strong performance.

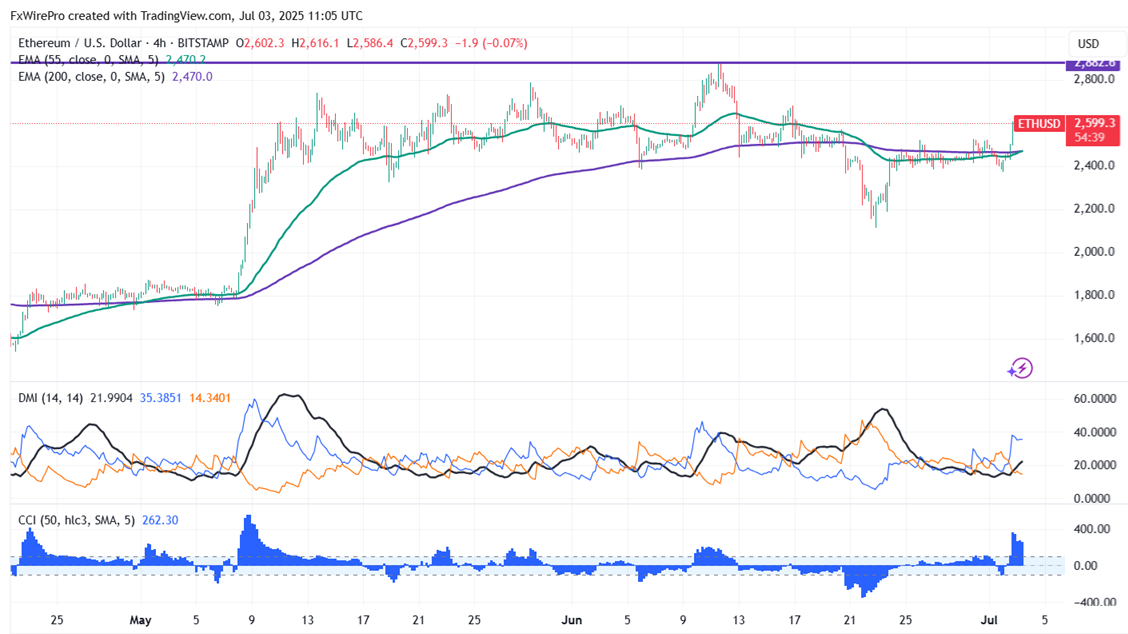

ETHUSD gained sharply yesterday, following the footsteps of BTC. It hits an intraday high of $2616 and is currently trading around $2598.

Overall trend remains bullish as long as support $2000 remains intact. Watch out for $2620, any break above targets $2681/$2720/$2770/$2880/$3000/$3400/$3600/$3800/$4000. A robust bullish trend will only materialize above $4100.

Immediate support is around $2500. Any violation below will drag the price down to $2435/$2374/$2000/$1750/$1675/$1620/$1500/$1200/$1000. A breach below $1000 could see Ethereum plummet to $800/$500.

It is good to buy on dips around $2500 with SL around $2300 for a TP of $3000/$4000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary