EUR/GBP exchange rate is seeing a bit of upside today, traded as high as 0.705, jumping back slowly from recent lows below 0.7 area.

Despite these noise, we at FxWirePro, remain firmly committed to our downside call for the pair to drop towards 0.62 area, with interim halt at 0.69 and 0.657 area. Since 2013, pair has declined steadily almost 1800 points, some more might still be in store.

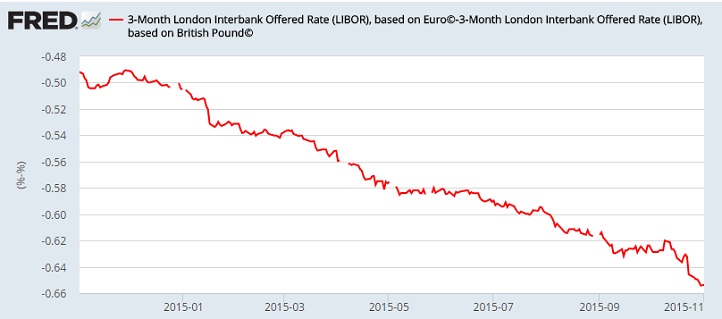

For the whole year 3 month Libor spread between Euro and Pound has declined steadily more than 16 basis points or more than 30%.

Recently Pound hike bets got scaled back due to dovish commentaries and scale backin inflation expectation from Bank of England, however we at FxWirePro, believe UK economy and Bank of England (BOE) is in much better position to go for a hike, while European Central Bank (ECB) looking to add more stimulus.

Moreover if inflation returns globally, rate hike from BOE would be much more swift, given their strategy to sell purchased assets later and BOE has much smaller balance sheet, compared to FED and ECB.