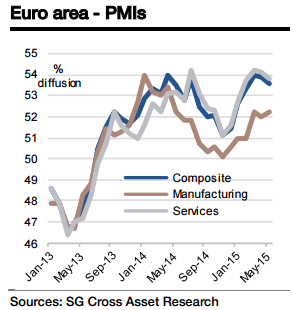

Despite continued uncertainty over China, which should have some negative effects on PMIs going forward, there is modest potential for upside surprises. Analysts believe that the current recovery in the euro area comes on the back of lower fuel prices and job creation, which have continued to boost disposable household income and spur the demand-led recovery. The manufacturing and service PMI levels would be consistent with GDP growth in the range of 0.4%-0.5% qoq, closeto their Q3 GDP forecast (0.4% qoq), argues Societe Generale.

No drastic change in the PMI values is expected in September. The composite PMI for the euro area as a whole will again be 54.3, with a decline in the manufacturing PMI balanced out by a slight increase in the more heavily weighted services PMI, states SocGen.

The story is also mixed on a country-by-country basis.

"The German manufacturing PMI is expected to fall from 53.3 to 52.6, while we forecast the equivalent French number to rise from 48.3 to 49.7. Similarly, there should be a fall in the German services PMI (54.9 to 54.5), but in France, this number should rise 50.6 to 51.5. We expect PMIs to continue around current levels in the coming months", estimates SocGen.

Euro area PMIs to remain steady in September

Wednesday, September 23, 2015 5:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022