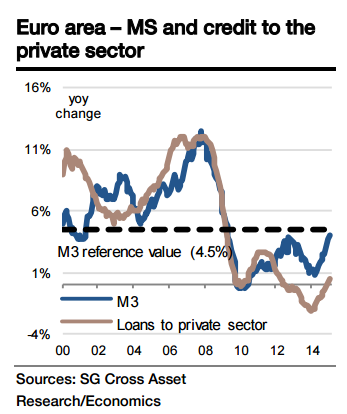

Money supply in the euro area has shown uninterrupted growth since last May, and this trend to have continued in February.

According to Societe Generale, M3 probably rose by 4.2% yoy, which would bring the three-month average to 4%. Looking ahead, the implementation of the QE that started in March should support this rising trend.

On the asset side, the ECB measures have already started to help ease credit supply and the private sector credit is expected to continue to improve gradually. The flow of credit loans to the private sector adjusted for sales and securitization rose by €24bn in January, bringing the annual growth rate from 0.2% to 0.5%. Further improvements are expected in February.

Euroarea monetary and credit dynamics likely improved in February

Thursday, March 26, 2015 6:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed